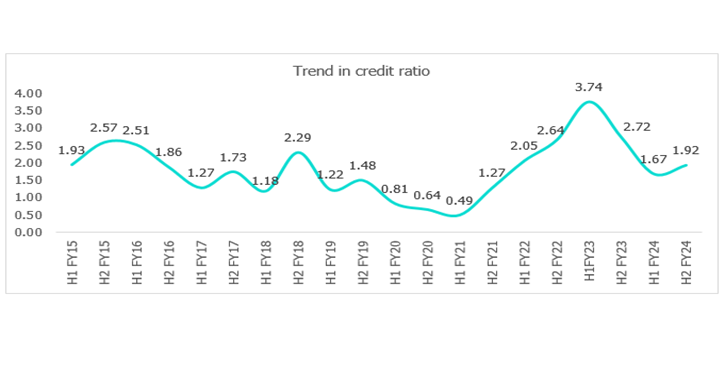

The moderation in the credit ratio can be mainly attributed to downgrades in a few large Non-Banking Financial Companies (NBFCs) groups due to legacy issues and the impact of the RBI regulations on some fin-techs.

While the BFSI sector’s credit ratio dipped, it continued to remain well above its long-term average credit ratio of 1.20 over the last 10 years. NBFCs also saw upgrades in H2FY24 with strong business performance, supported by scaling up and resultant improvement in profitability.

Banks saw upgrades in H2FY24, mainly triggered by sustained improvement in asset quality, comfortable capitalisation and profitability, mainly in the mid-sized banks.” He added, “Net Non-Performing Assets (NPA) have reached a historic low of 0.7% in Q3FY24.

Moreover, despite rising interest rates, profitability in mid-sized NBFCs/ financial services is expected to be protected, with business growth leading to optimization of operating expenditure, moderated increase in interest rates and controlled credit costs. Credit outlook is expected to be stable for the sector.”