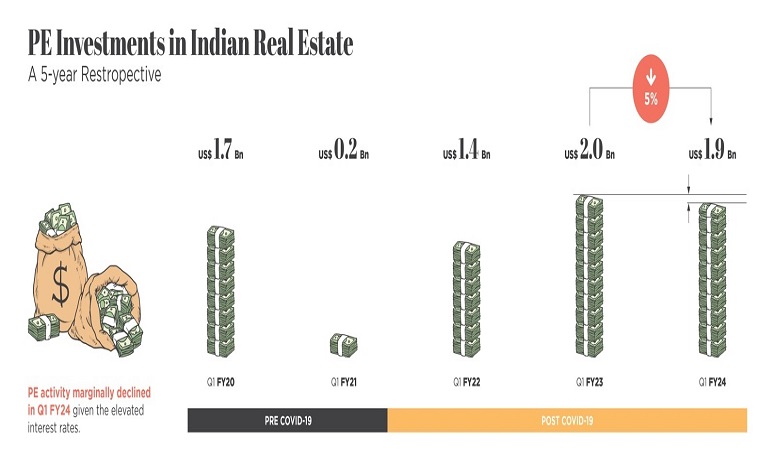

Q1FY24 saw a mild softening in reported deal activity when as compared to Q1FY23 on a headline basis, finds ANAROCK Capital’s report FLUX for Q1 FY24. The reported numbers were propped up by a single large deal which accounted for about 3/4th of the overall deal activity.

Shobhit Agarwal, MD & CEO – ANAROCK Capital, says, “Excluding this deal, private equity activity remained subdued owing to a high interest rate environment and global uncertainties. PE transactions in Indian real estate are, in any case, tilted towards equity investments in office assets by foreign investors. The single large deal between the consortium of GIC and Brookfield REIT with Brookfield AMC has further skewed the mix during the quarter.”

The average ticket size went up sharply in Q1 FY24, driven by a single large transaction in which a sovereign wealth fund partnered with a REIT to buy out commercial assets. The share of this top PE deal is 74% of the total PE deals in Q1 FY24. The global economic environment remains uncertain amidst the backdrop of elevated interest rates. Consequently, it is not surprising that deal volumes, with the exclusion of the Brookfield-GIC transaction, were soft in the quarter gone by.

Funding remained dominated by equity funding transactions. Like in Q1 FY23, foreign investors accounted for most of the activity in Q1 FY24. Overall activity remained muted with headline numbers boosted by a large single deal, with assets across locations.

City specific PE investments are higher than the number suggests. However, they are part of the portfolio deals (multiple cities) where the bifurcation amongst the cities is not available. Driven by the Brookfield India RE Trust REIT - GIC transaction, investments in commercial real estate accounted for most of the activity in Q1 FY24.